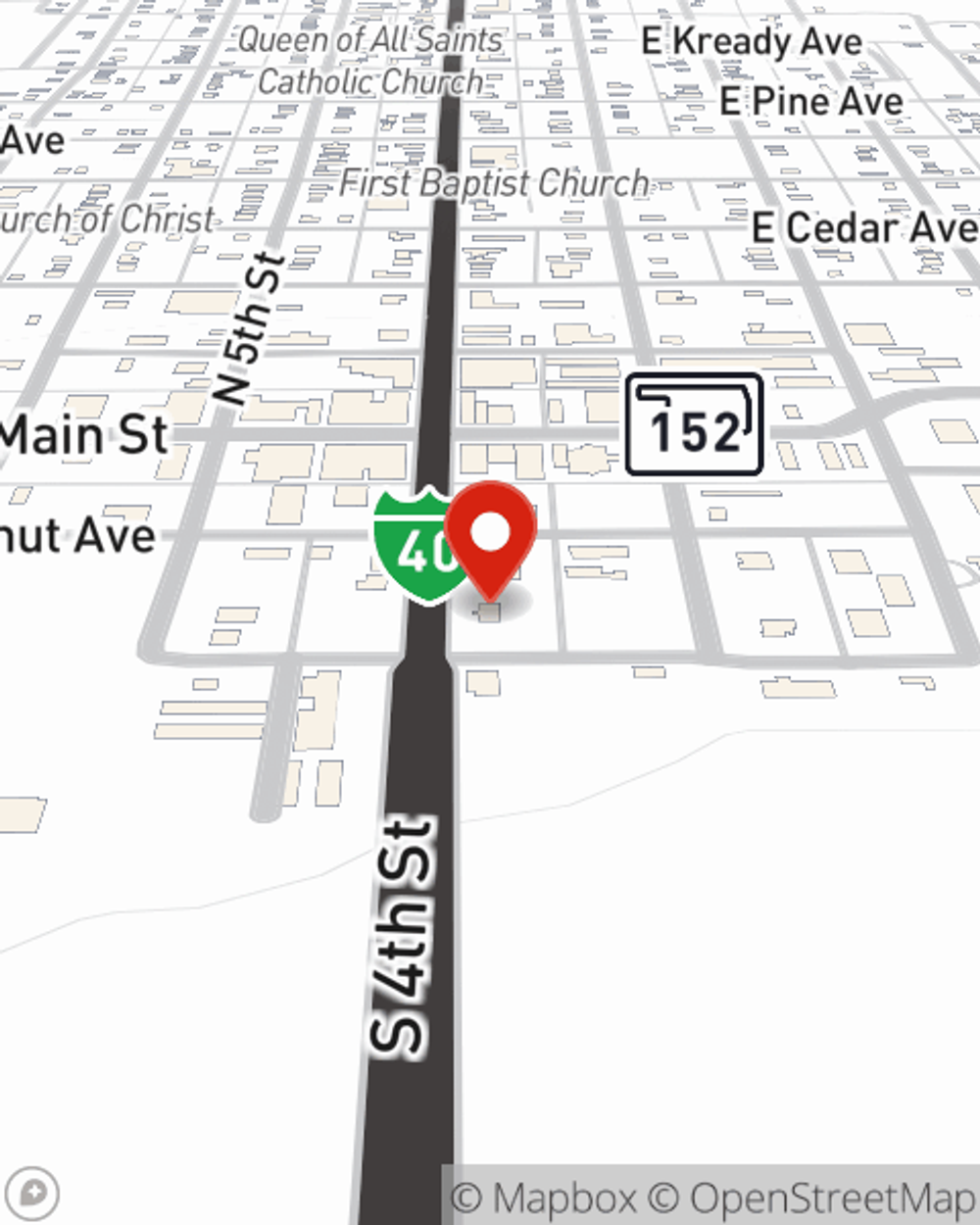

Business Insurance in and around Sayre

One of Sayre’s top choices for small business insurance.

Helping insure small businesses since 1935

Cost Effective Insurance For Your Business.

When experiencing the challenges of small business ownership, let State Farm take one thing off your plate and help provide outstanding insurance for your business. Your policy can include options such as worker's compensation for your employees, business continuity plans, and errors and omissions liability.

One of Sayre’s top choices for small business insurance.

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

At State Farm, apply for the outstanding coverage you may need for your business, whether it's an interior decorator, a book store or a bakery. Agent Lisa Prentiss is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Reach out agent Lisa Prentiss to learn more about your small business coverage options today.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Lisa Prentiss

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.